Cosmetics, Credibility and the Warsh Nomination

Fire-selling Treasury bonds and Estée Lauder's China problem

How should we think about Kevin Warsh’s credibility as Fed Chair?

The answer impacts the recent Dollar relief rally, Warsh’s Senate confirmation, US monetary policy, and the world economy’s future. Markets are voting with their feet. Apparently, it’s safe to buy the Dollar again and unceremoniously dump gold, silver, Euros, etc.

Pundits are herding around the idea that Warsh is ‘not great’, but ‘probably ok’.

He previously served on the Fed without scandal and has sensibilities consistent with status quo Wall Street, while keeping the MAGA crowd happy. Thus, the investing public can trust him to ignore the extremes of low-interest rate policy. The Dollar is not going to be debased: even if Trump keeps demanding low rates to reduce the deficit and keep voters happy.

That reasoning is lightweight, at best. It ignores the detail of Warsh’s plans for the Fed and the real dangers for him if he disobeys Trump.

Here are three deeper ways to think about the topic.

1. Do Warsh’s ideas make sense?

Smart people have doubts. Krugman called Warsh ‘an effective bullshitter’ with ‘no coherent argument behind the verbiage’, but didn’t actually explain the incoherence. Wolf just published a retrospective of Warsh’s ‘confused’ thinking, but didn’t focus on his audition letter for Fed Chair. I’ll fill in some gaps below. Spoiler alert: Warsh’s plans for the Fed are wildly incoherent.

2. What types of pressures are likely to hit Warsh and how would he resist them?

Most people assume that Trump would simply express displeasure at a stubborn Warsh by trolling him or being nice because Warsh’s father-in-law is Trump’ college pal who likes Greenland. I think that view overlooks Warsh’s personal exposure to Trump’s trade policy and the President’s tendency to weaponize the government against businesspeople who displease him. Chris Giles assigns a ‘significant’ likelihood that ‘Trump comes to hate’ Warsh, but doesn’t explains what happens next.

A possible outcome, involving the vulnerabilities of Warsh’s family wealth to Trump’s trade war is detailed below.

3. Is Warsh better credentialled or less partisan than Hasset, Miran, Bessent?

Yes, obviously, but relief about the past is not a basis to forecast the future.

Warsh for Low Rates, No Government Financing and other Fantasies

Let’s kick-off by reviewing the ideas that Warsh has actually put forward.

Warsh’s audition letter was a jingoistic WSJ Op-Ed in which he declared that ‘inflation is a choice’, while (in one breath) confusing and refuting most modern economics by declaring that the Fed ‘should abandon the dogma that inflation is caused when the economy grows too much and workers get paid too much’. Pegging himself as a fiscal-theory of the price level dogmatic, Warsh bluntly says ‘Inflation is caused when government spends too much and prints too much’. He told readers that all current Fed GDP forecasts are wrong because ‘AI will be a significant disinflationary force, increasing productivity and bolstering American competitiveness.’

Warsh later said he wants to deeper cooperation with the Treasury: ‘We need a new Treasury-Fed accord, like we did in 1951 after another period where we built up our nation’s debt and we were stuck with a central bank that was working at cross purposes with the Treasury. That’s the state of things now’.

To summarize, Warsh believes in low-rates (today) based on AI productivity gains (in the future). He wants to liquidate the Fed’s massive government bond holdings because QE is debt monetisation which he say is outside the Fed’s mandate. He also wants to negotiate a new ‘accord’ with the Treasury which revises the famous (but infrequently read) 1951 Accord to reduce inflationary pressures through government ‘printing too much’.

None of that makes any sense.

Fire-Selling the Fed’s Balance Sheet = Jacking Up Rates

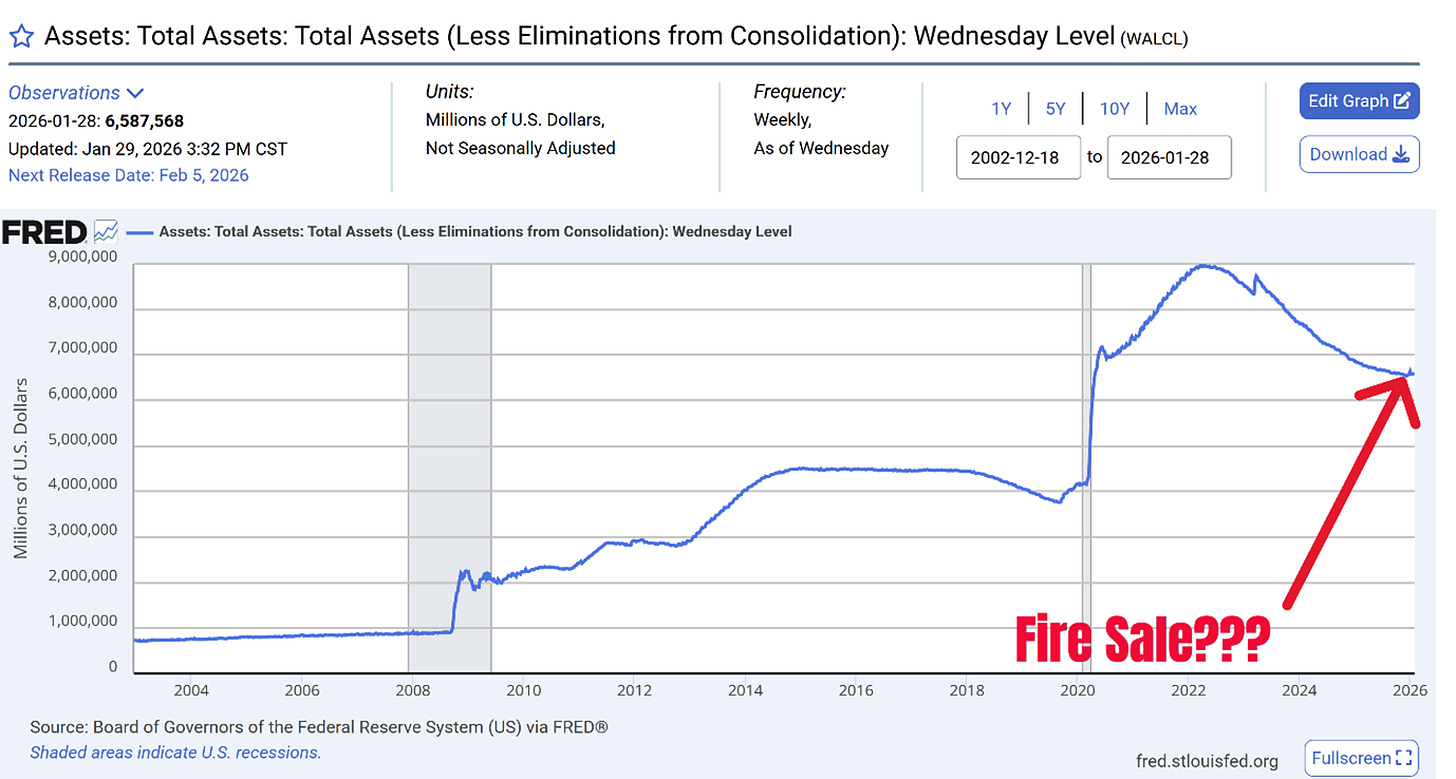

Selling down the Fed’s $6.6 trillion balance-sheet will jack-up rates, particularly the cost of refinancing the government’s massive-debt load and all investments linked to the Treasury yield curve.

My research revealed internal Fed’s modelling from 2013 which found that ‘[$500billion of US government debt] purchases decrease outstanding federal debt about $300 billion by 2025, a change equivalent to a 1.4 percentage point reduction in the federal debt-to-GDP ratio’. Radically reducing the Fed’s government debt holdings is almost certain to have the opposite effect: massively increasing the cost of funding the US government. While selling $500billion may not increase the cost of funding by preisely +1% of GDP, no one (let alone Warsh) has attempted to explain how to sell-down the Fed’s System-Open Market Account’s debt portfolio without jacking up systemically-critical Treasury yields.

You don’t need to be a Trump-whisperer to know that increasing the cost of the national debt is a no-no. He says the quiet part out loud: ‘If “Too Late” at the Fed would CUT, we would greatly reduce interest rates, long and short, on debt that is coming due. Biden went mostly short term. There is virtually no inflation (anymore), but if it should come back, RAISE “RATE” TO COUNTER. Very Simple!!! He is costing our Country a fortune. Borrowing costs should be MUCH LOWER!!!’.

The only thing Trump seems to like about Powell’s Fed is its sneaky decision in December 2025 to re-start government debt purchases under the chameleon terminology of Reserve Management Purposes to ‘ensure ample reserves’. Ample for what? Cheaper government financing! Saliently, neither Trump nor Bessent have rage-posted about the Fed’s new bond buying program. The idea that Warsh would stop it (at least without actioning another form of fiscal support) without inflaming the White House is fanciful.

Reversing the Volcker Years: AKA a ‘New Accord’

Warsh keeps saying that government debt support (via bond buying) is outside the Fed’s mandate and requires an adjustment to the 1951 Accord. As I’ve detailed in a few different places, the Fed has been doing government debt support since 1917, although it usually hides it from the public.

Warsh should have the research skills (from his non-quant degrees) to avoid saying wildly-historically inaccurate things like this:

We need a new Treasury-Fed accord, like we did in 1951 after another period where we built up our nation’s debt and we were stuck with a central bank that was working at cross purposes with the Treasury. That’s the state of things now.

That is the opposite of what motivated the 1951 Accord. After the War, the Treasury was forcing the Fed to keep rates low, and the Accord freed the Fed to lift rates in ways that increased the cost of re-financing the War debt.

The 1951 Accord was focused, exclusively, on reducing the Fed’s role in government debt monetization:

The Treasury and the Federal Reserve System have reached full accord with respect to debt-management and monetary policies to be pursued in furthering their common purpose to assure the successful financing of the Government’s requirements and, at the same time, to minimize monetization of the public debt.

If Warsh wants to revise that Accord, does he want to increase the Fed’s role in government financing? Remember, Warsh also thinks government spending causes inflation, and the pre-Accord system was designed to support deficit spending. Radical inconsistencies abound in that thinking.

The real aim appears to be giving the Treasury more power over monetary policy. I’ll talk about some of the current shenanigans in the Treasury to distort the public debt market in a later post. For now, it’s obvious that any future Accord will undermine the idea of ‘monetary dominance’: ie, the amount of money the Treasury can raise being limited by the central bank’s decisions on monetary policy.

Monetary dominance underpins the whole structure of independent central banking because it subordinates the Treasury to the Fed: something Trump clearly hates. Prior to Volcker, supporting the Treasury to manage public debt was an active ‘third leg’ of monetary policy: the Fed had to think about how to finance the government when setting rates. Volcker’s big claim was that he stamped that out, although I’ve argued that he didn’t succeed.

It is abundantly clear that any Accord with Bessent and Trump will destroy the brave new world Volcker built in the early 1980s.

The Low-Rate AI-Guy

Apparently, Warsh’s low-rates (today) will come from yet-undiscovered AI productivity gains (in the distant future).

The details are hazy, but the basic idea is to fuel the looming AI productivity boom with low rates because any short term inflation will be subsumed by the massive influx of low cost AI-powered goods and services. This is tech utopian magical-thinking that echoes Sam Altman’s pitch to make OpenAI revenue positive:

We have never made any revenue. We have no current plans to make revenue. We have no idea how we may one day generate revenue. We have made a soft promise to investors that once we’ve built this sort of generally intelligent system, basically, we will ask it to figure out a way to generate an investment return for you.

Intelligent arguments to replace inflation targeting with nominal GDP targeting (a version of Warsh’s pitch) have been made. Warsh’s is not one of them: touting the frothiest of asset bubbles as the secret weapon of US enterprise. He argues that American ‘large language models’ will outcompete foreign offerings because ‘[US tech companies’] market capitalizations...dwarf their overseas peers’. Praising a speculative equity bubble in 2025 reminds me of this Greenspan quote from October 2005:

development of financial products, such as asset-backed securities, collateral loan obligations, and credit default swaps, that facilitate the dispersion of risk … These increasingly complex financial instruments have contributed to the development of a far more flexible, efficient, and hence resilient financial system than the one that existed just a quarter-century ago.

Immune to irony, Warsh says that ‘the new tax bill, which the president signed in July has already spurred massive new capital investments, including in high-value manufacturing and data centers.’ Given that Trump’s Big Beautiful Bill is projected to add ~3trillion to the national debt by 2035, the very source of Warsh’s GDP growth is also the sole source of inflation: government spending.

If Warsh has a coherent plan for the Fed, it does not exist in the public domain.

Warsh’s personal exposure to Trumpism

Credibility is not just about your personal ethics, it is also about what the world throws at you. Even good people have their breaking points.

That maxim is the theoretical core of central bank independence, which insulates monetary policy from politics because of humans’ susceptibility to incentives, not their moral virtue. The fathers of new classical economics all argued that elected politicians relied on voters for their money/status, and so separating central banks from politicians was the only was to create economic stability. That style of ‘public choice theory’ sits at the heart of investors yearnings for an independent Fed.

Critical thinkers should be asking: is Warsh’s money/status vulnerable to the political cycle in a way that could affect his policy-making?

A recent article noted a college-era personal friendship between Trump and Warsh’s father-in-law who also has business interests in Greenland. The implications are (a) that Warsh may do Trump’s bidding or (b) Trump will avoid publicly-attacking the Fed because (c) Warsh’s father-in-law is friendly with Trump.

That approach misses a much bigger point of leverage Trump has over a stubborn Warsh: his family stake in Estée Lauder Companies Inc which is both struggling financially and hugely exposed to China.

American Cosmetics and the China Trade

Warsh married into his high-wealth. He is the husband of Jane Lauder, a senior executive of Estée Lauder and an heir to the Lauder fortune. The basis of that fortune is equity in the US luxury cosmetics conglomerate: Estée Lauder Companies Inc, the owner of brands such as The Ordinary, Tom Ford, Clinique, MAC and the eponymous Estée Lauder.

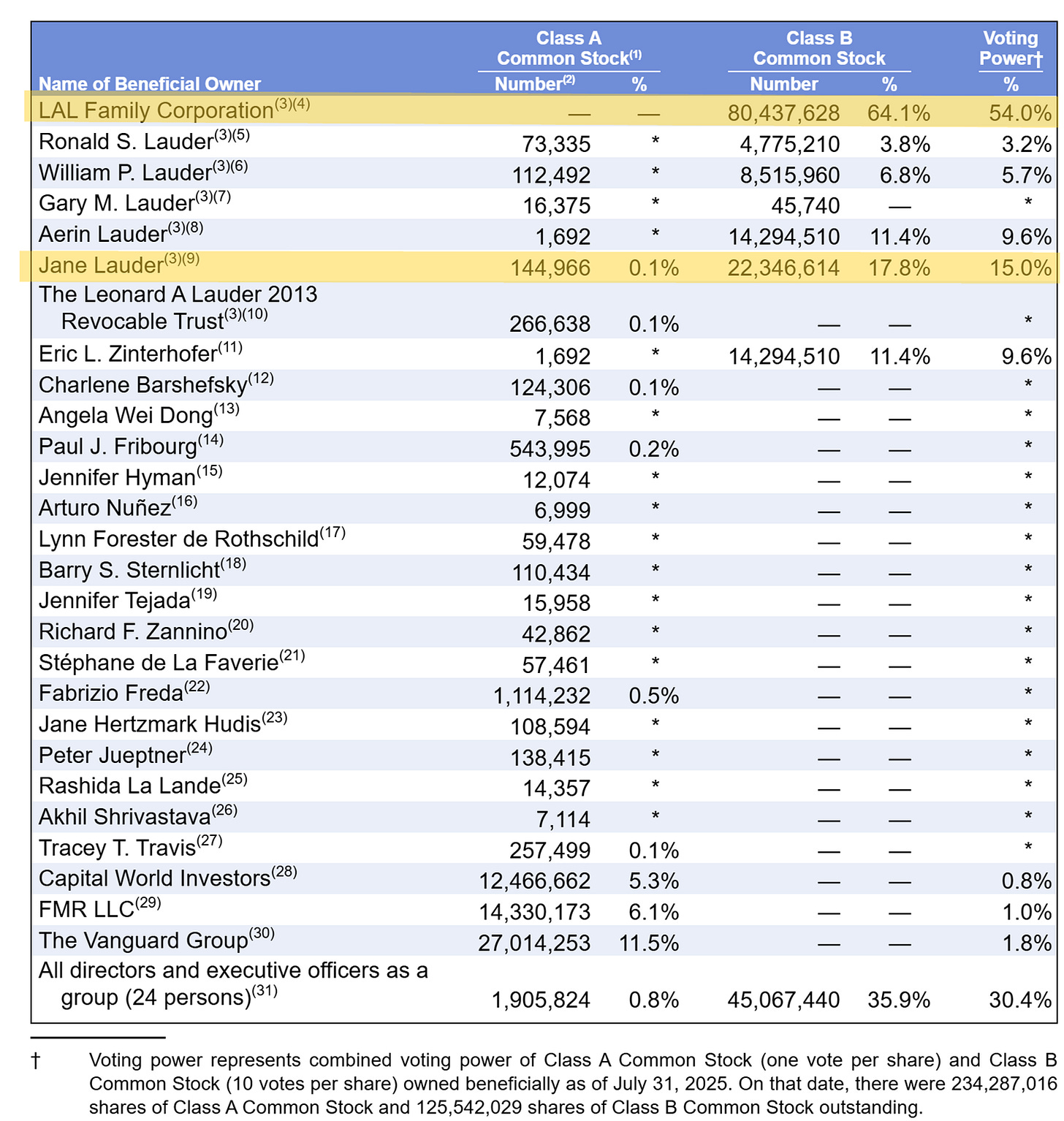

Jane Lauder’s net worth is estimated at +$2.7 billion. Most recently, Estée Lauder reported that she owned preferential shares (as a Lauder family member) directly giving her 17% voting power and 64% as a member of various family trusts. Thus, Warsh’s wife has the largest single voting stake in a Fortune 500 company.

Estée Lauder has a China-forward strategy: targeting sales and marketing to serve the growing Chinese middle class. Like all cosmetics giants, its supply chains had long been dependant on China, but Estée Lauder’s strategic goal is to sell to the ‘enormous amount of new consumers that are coming into the middle class’ in China.

Things aren’t going well.

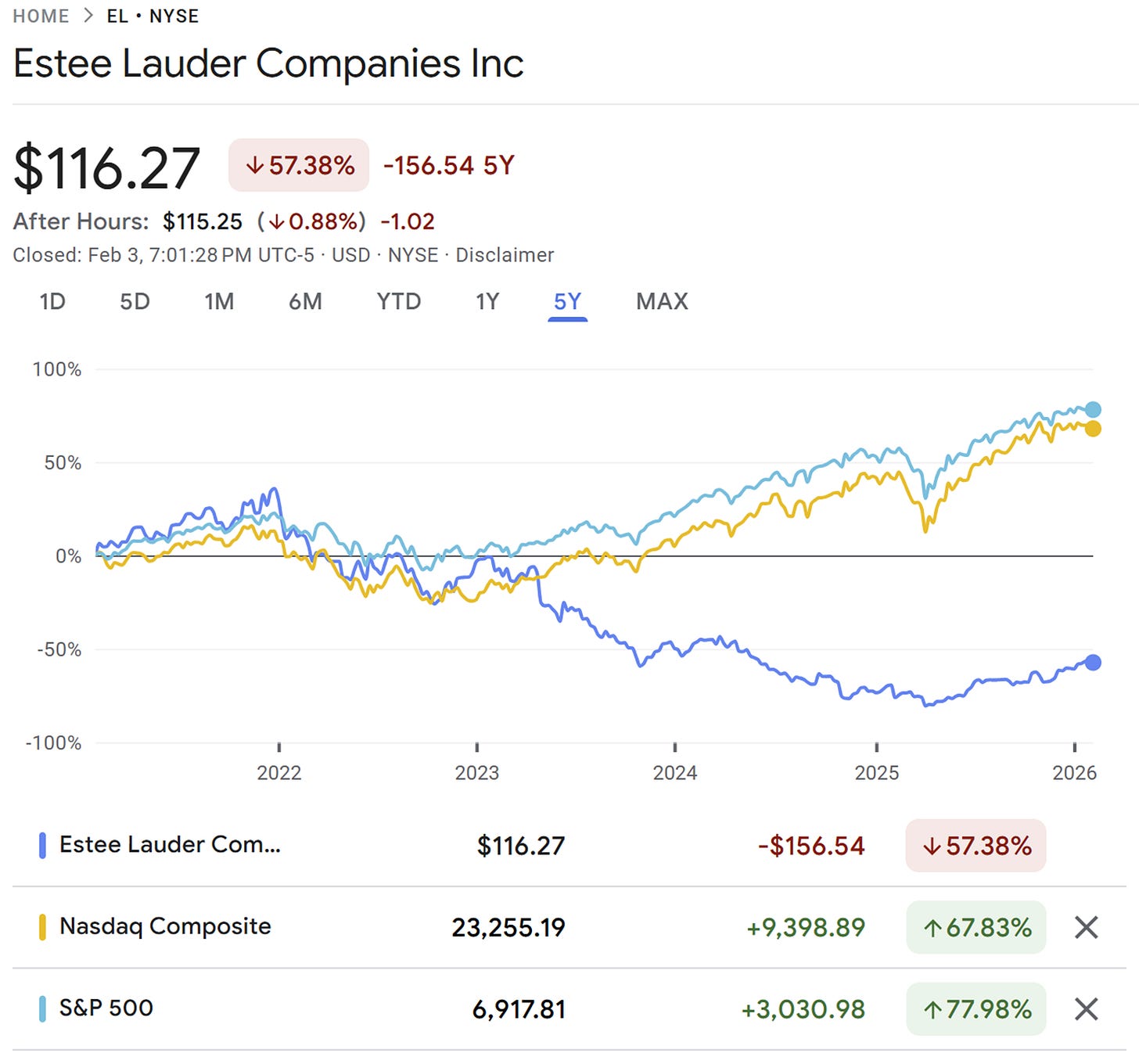

Covid walloped the company’s Asian travel markets and the following domestic Chinese economic crisis also hit mainland sales. Stock prices have massively-lagged the major US indices since peaking in the buy-everything Covid rally.

Trump’s ‘Liberation Day’ trade war also took a toll.

Like most big US corporates, Estée Lauder reported tariff changes as a major operational risk in their 2025 Annual Report:

We are continuing to monitor and assess the potential effects of new and existing tariffs in the United States as well as in other markets in which we operate. These tariffs have led to significant volatility and uncertainty in global markets and difficulty in forecasting demand. We have implemented and are continuing to implement and consider additional mitigation measures. The impact was not material to fiscal 2025 profitability and cash flows, however, even if we can minimize some of these impacts, we anticipate higher tariff rates to have an adverse effect on fiscal 2026 profitability and cash flows, and depending on actual rates and countries imposing tariffs such adverse impacts could be material.

Unlike most big US corporates, the husband of a majority owner of a tariff-exposed corporate has been nominated to lead the central bank.

Rocks and Hard Places: October 2026 and Taiwan 2027

Estee Lauder’s current CEO is not backing away from the China pivot, telling the Financial Times in November 2025: ‘The next China is China’.

In October 2026, Trump’s tariff ceasefire with China expires. By 2027, China aims to have the capability to re-take Taiwan by military means. Mid-term elections, very tough for Trump, are scheduled between those dates.

An embattled corporate giant with a heavy dependency on Chinese trade will be particularly exposed to those events. In the worst-case scenario, corporate survival will depend on exemptions Trump gave to (eg) Apple Inc in earlier phases of the trade war.

Now, picture the future world of Fall 2026: ugly mid-term polling, trade with China re-weaponized, Trump wants lower rates, the FOMC won’t give in and Warsh refuses to twist arms in the Eccles Building.

An obvious point of pressure will be Estée Lauder. If that pressure is applied, the only relevant question becomes: what would Kevin Warsh and his family be willing to lose to maintain price stability?

Credibility under Pressure

There is some precedent for Fed Chairs baiting and switching on Presidents.

The funniest example is Chair Martin who promised Truman not to raise rates shortly after the 1951 Accord, then promptly did. Truman called him a ‘traitor’ when he bumped into him on the street. Another is Volcker, who assumed the role under Carter and then drove the institution hard against the President.

Investors who assume the Dollar is safe again after Warsh’s nomination must think he’ll do something similar.

They might be right, but the last two Presidents to get suckered by Fed Chairs were Truman and Carter.

Hoping Trump will accept similar treatment is not credible.

Future posts will talk about

Shenanigans in the Treasury’s sovereign debt sales

Exposure of the foreign exchange system to Trumpism

How to think about ‘safe haven’ in a pre-War economy

If you like this post, you’ll love my next book The Fiscal Fed: How the US Central Bank Funds Government, out in Fall 2026 with Chicago University Press.

Thanks to Jens, Leah and Monica for their feedback.

This is a really fasinating look at the whole accord situation. Your point about how any new agreement with Treasury would basicly reverse Volcker's independence gains really hits home. I remeber when my uncle worked in fixed income and how the Fed's bond purchaces always seemed to move markets more than ppl admitted. Its kinda wild that Warsh wants to revisit something that was designed to reduce debt monetization in the first place.